European VOD - millions of eyes, billions in cash

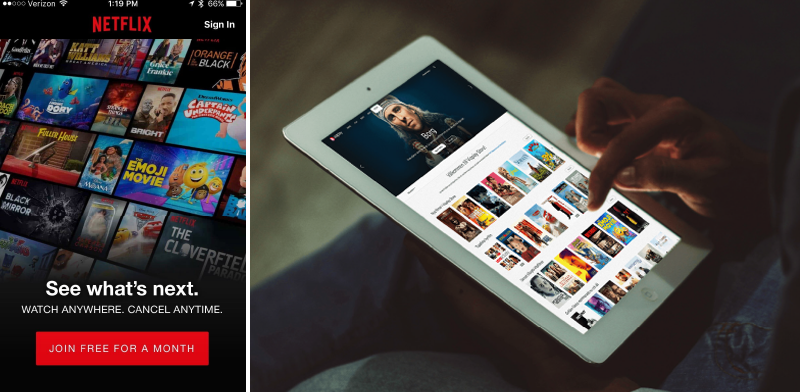

If there is one name that has become synonymous with the Video on Demand (VOD) era we live in currently, it is Netflix. Its initial business model included DVD sales and rental by mail, but the company soon abandoned the sales and focused on the DVD rental business. Netflix expanded its business in 2007 with the introduction of streaming media starting the era of VOD in the entertainment business.

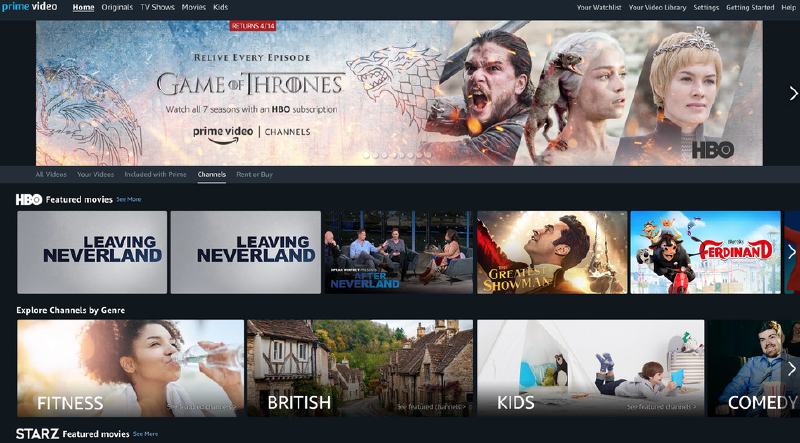

Netflix has undoubtedly set the pace and, more importantly, the direction for development of similar services like Hulu, Amazon Prime, etc. The “old” generation of broadcasters, however, still dominates and 2019 will definitely become a pivotal year for the SVOD market, with Disney, WarnerMedia and Apple planning to launch their own services. Most of these huge investments will be focused on the US audience but Europe is also on the radar as the hunger for VOD content on the rich Old Continent continues to grow.

Netflix has undoubtedly set the pace and, more importantly, the direction for development of similar services like Hulu, Amazon Prime, etc. The “old” generation of broadcasters, however, still dominates and 2019 will definitely become a pivotal year for the SVOD market, with Disney, WarnerMedia and Apple planning to launch their own services. Most of these huge investments will be focused on the US audience but Europe is also on the radar as the hunger for VOD content on the rich Old Continent continues to grow.

In one of its recent reports, Rethink notes that SVOD (Subscription Video on Demand) uptake is accelerating and in terms of hours viewing per day it will shortly draw level with broadcast TV globally by 2023.

Just a few days ago, The Motion Picture Association of America (MPAA) reported that last year streaming subscriptions surpassed cable television for the first time, with 131.2 million new subscriptions added, rising to 613.3 million worldwide. However, cable subscriptions still make the most money, increasing by $6.2 billion to $118 billion.

Rethink notes that the global forecast shows the stark contrast between the heavily AVOD (Advertising Video on Demand) Asia compared to the SVOD frenzy going on in the US and Europe. The US market will rise from a combined paid SVOD (including vMVPD) and reach 236.6 million subscriptions by the end of 2023, from a base today of some 146.5 million. Europe and Asia will be neck and neck in SVOD revenues by 2023, but with far fewer subscribers in Europe, each paying significantly more than those in Asia.

Netflix will continue to lead in subscriber numbers (outside of China) but will make up 194 million SVOD customers out of 743 million globally by 2023, some 26% of total global subscribers. Europe will see a mix of different approaches with Netflix and Amazon now established, US studios beginning to stake a claim, and local broadcasters trying to challenge them.

Naturally, all of this drives the content spend. By Ampere Analysis’s estimates, the combined projected content spend of Disney and Comcast only is set reach $43 billion per year on originated and acquired content. This is more than the combined outlay of the next ten largest content spenders in the US including OTT platforms Netflix and Amazon. All of them have declared a significant increase in content spend for European content.

According to Digital TV Research’s European TV Databook, SVOD subscriptions in Europe tripled between 2015 and 2018 to 76 million, while traditional pay TV only added 8 million subscribers to total 186 million. This means that SVOD’s share of the total TV subscription market grew from 13% to 29% between 2015 and 2018, and including AVOD reached $14 billion; up from $6 billion in 2015. Pay TV revenues remained flat at $36 billion.

S&P Global Market Intelligence published its European Subscription Online Video 5-Year Outlook in February this year. According to the company, revenues from the subscription over-the-top market in Europe are expected to double over the next five years, reaching $12.7 billion in 2023, according to Kagan estimates. This growth is due to a number of different factors, including the expansion of international media players in the region as well as new service launches by local players, both by incumbents and smaller media groups. Formed alliances in the United Kingdom, Germany and France among broadcasters will further intensify the competition in the OTT landscape.

Netflix is the leading service in paid subscriptions in all markets but Germany, Poland and Russia. Amazon Prime Video is still ahead of Netflix in Germany, having capitalized on the initial success of Amazon Prime. In Eastern Europe, where the language barrier is more prevalent compared to that of Western European territories, the local and regional services attract the most subscribers.

Looking at the wider picture, in 2018 Netflix and Amazon Prime Video were behind 72% of the total paid subscriptions and 71% of the total revenues in 18 European markets included in the analysis. Ampere notes that 53.9 million people were subscribed to one of the 183 different SVOD platforms operating in Europe in 2017. The local players, however, had a significantly lower share: UK’s Now TV (2.7%), Italy’s TIM Vision (2.5%) and Germany’s Maxdome rounded off the Top 5.

Streaming services are especially popular in the Nordics with Denmark, Norway, Sweden and Finland showing penetration rates between 47% and 73% in 2018, followed by the U.K. with 41%.

The Nordic countries lead the European VOD market partly because of the high percentage of English-speaking population, high speed and reliable broadband, a large selection of services — many of which offer livestreaming TV networks — and a number of partnerships between online and traditional players. Denmark leads the European market in terms of penetration with 53% of the households using such services and 35% subscribed to two different streaming offers.

In the Nordics, however, Netflix and Amazon have a smaller share than in the rest of Europe (39% - according to Mediavision) which is explained with the increased competition from local actors – the biggest one being Viaplay with nearly 1.3 million subs. Both C More and Viaplay generated a 2% share of the total European SVOD revenues (€3.65 billion) in 2017, according to Ampere. In Denmark, Netflix holds 44% share, HBO Nordic - 23%, Viaplay - 22%, TV 2 Play - 21% (reported half a million subs) and C More - 7%.

AVOD in the Nordics is also huge thanks to the Play services of the major commercial nets and in 2018 alone the market grew by 20%, according to IRM. Bonnier Broadcasting’s TV4 Play reported 4.7 million subscribers for 2018 with its share on the Swedish commercial streaming market increasing to 54%. Discovery’s Dplay grew the most in terms of started streams and reached 17% share.

The public broadcasters also manage to remain relevant and in Finland the public streamer Yle Areena is the most popular platform on the market. The services of DR, NRK and SVT are also ranked second in their markets.

In the UK, BBC iPlayer is also a force to be reckoned with. Last year, 3.6 billion programs were requested on the platform, with Bodyguard’s Episode 1 getting the most streams – over 10.8 million.

The latest data from BARB (The Broadcasters’ Audience Research Board) shows that the number of homes now accessing at least one among Netflix, Amazon or Now TV in the UK has grown by 5.7% to reach 12.3 million, with 660.000 additional homes taking at least one SVOD service compared to the previous quarter. Whilst every Q4 has shown growth, Q4 2018 was the lowest since 2014. Quarter-on-quarter growth for Q4 was 7.6% in 2017, 8.7% in 2016, 6.6% in 2015 and 3.7% in 2014. 43% of homes now have access to one of these SVOD services in the UK. In a recent netgem.tv survey, 59% of the respondents said they have pay TV at home and 58% said they have a Netflix or Amazon Prime TV account.

Futuresource Consulting published a report in January about the German video market – it stepped up its dynamic transition in 2018, driven by subscription spending. Consequently, it is the 5th largest in the world with an estimated annual spend of €9 billion in 2018, up 6% on 2017. The annual consumer spend is on course to exceed €10 billion by 2022. There are now over 10 million households subscribing to one or more SVOD service. Here, Netflix increased its subscriptions with 50% in 2018 alone. Last year, data from Ampere and VOD service Cirkus forecasted that Germany may surpass the UK as Europe’s strongest video-on-demand market.

France is the third biggest European SVOD market in terms of revenues but well outside the Top 10 markets in terms of subscribers but catching up fast. In 2018, the French VOD market grew by 82.7% to reach €455 million. Netflix now counts 4 million clients in France, while the local broadcasters are planning to unite their forces with the launch of the rival service Salto.

Spain and Italy are in a similar situation, generating around 200 million per year in 2017 with a penetration of less than 20%. However, a recent study by Ernst & Young showed that in Italy paid video subscriptions increased from 2.3 to 5.2 million in 2018, getting closer to the 6.5 million mark of pay TV subs. The number of SVOD users has nearly doubled to 8.3 million, and with AVOD the reach jumps to 23.8 million.

In the Netherlands, Netflix clearly dominates the SVOD market with close to 3 million households using the service. The closest competitor is RTL’s Videoland which has about six times less subscribers, even though their number increased with 135% in 2018 and the VOD revenues reached €216 million. At the same time, SKO estimated that 59% of the population aged 6+ watched content for the national broadcasters online last year. Shows that also aired on TV reached 3.2 million viewers, while the web-only projects had 2.6 million viewers. Shows that also aired on TV reached 3.2 million viewers, while the web-only projects had 2.6 million viewers. The monthly online reach for the channels was 3.7 million. NPO reached 2.583.000; RTL - 1.199.000 and Talpa TV - 513.000 viewers online.

Russia is the biggest VOD market in Eastern Europe with an estimated value of 23.6 billion rubles (approx. $368 million) growing nearly 50% last year. The biggest platform ivi which combines the SVOD and AVOD model counted 43 million unique users in 2018. The number of paying customers doubled in one year to 1.2 million. The revenue increased by 62% to 3.9 billion rubles. Leading SVOD service Okko increased its revenues by 81% last year, reaching 2.5 billion rubles. Its monthly audience in 2018 was 1.83 million people, up from 1.5 million in 2017.

In Poland SVOD services are also becoming increasingly popular. Data published by Statista shows that revenue in the segment will amount to $145 million in 2019. Revenue is expected to show an annual growth rate (CAGR 2019-2023) of 1.6%, resulting in a market volume of $155 million by 2023. The user penetration is 18.3% in 2019 and is expected to hit 20.2% by 2023. The average revenue per user (ARPU) currently amounts to $20.81.

According to a survey by Projekt Cyfrowizja IV, as many as 24% customers of satellite and cable platforms have been considering discharging paid services last year, most often customers of the most expensive plans (over PLN 100 monthly subscription - 30%).

The rise of the popularity of SVOD services in Europe has also attracted the attention of the European politicians and in October 2018 the EU approved content quotas. The new regulations will take effect on Sept. 19, 2020 and will require video-streaming companies that operate in the EU to ensure that 30% of their catalog is made up of European works. However, what “30%” means isn’t yet clear—it could refer to hours of content, number of videos, or something else altogether. Clarifications will be made by the end of 2019, after which streaming companies will have less than a year to comply with the finalized rules.

Just a few days ago, The Motion Picture Association of America (MPAA) reported that last year streaming subscriptions surpassed cable television for the first time, with 131.2 million new subscriptions added, rising to 613.3 million worldwide. However, cable subscriptions still make the most money, increasing by $6.2 billion to $118 billion.

Rethink notes that the global forecast shows the stark contrast between the heavily AVOD (Advertising Video on Demand) Asia compared to the SVOD frenzy going on in the US and Europe. The US market will rise from a combined paid SVOD (including vMVPD) and reach 236.6 million subscriptions by the end of 2023, from a base today of some 146.5 million. Europe and Asia will be neck and neck in SVOD revenues by 2023, but with far fewer subscribers in Europe, each paying significantly more than those in Asia.

Netflix will continue to lead in subscriber numbers (outside of China) but will make up 194 million SVOD customers out of 743 million globally by 2023, some 26% of total global subscribers. Europe will see a mix of different approaches with Netflix and Amazon now established, US studios beginning to stake a claim, and local broadcasters trying to challenge them.

Naturally, all of this drives the content spend. By Ampere Analysis’s estimates, the combined projected content spend of Disney and Comcast only is set reach $43 billion per year on originated and acquired content. This is more than the combined outlay of the next ten largest content spenders in the US including OTT platforms Netflix and Amazon. All of them have declared a significant increase in content spend for European content.

According to Digital TV Research’s European TV Databook, SVOD subscriptions in Europe tripled between 2015 and 2018 to 76 million, while traditional pay TV only added 8 million subscribers to total 186 million. This means that SVOD’s share of the total TV subscription market grew from 13% to 29% between 2015 and 2018, and including AVOD reached $14 billion; up from $6 billion in 2015. Pay TV revenues remained flat at $36 billion.

S&P Global Market Intelligence published its European Subscription Online Video 5-Year Outlook in February this year. According to the company, revenues from the subscription over-the-top market in Europe are expected to double over the next five years, reaching $12.7 billion in 2023, according to Kagan estimates. This growth is due to a number of different factors, including the expansion of international media players in the region as well as new service launches by local players, both by incumbents and smaller media groups. Formed alliances in the United Kingdom, Germany and France among broadcasters will further intensify the competition in the OTT landscape.

Netflix is the leading service in paid subscriptions in all markets but Germany, Poland and Russia. Amazon Prime Video is still ahead of Netflix in Germany, having capitalized on the initial success of Amazon Prime. In Eastern Europe, where the language barrier is more prevalent compared to that of Western European territories, the local and regional services attract the most subscribers.

Looking at the wider picture, in 2018 Netflix and Amazon Prime Video were behind 72% of the total paid subscriptions and 71% of the total revenues in 18 European markets included in the analysis. Ampere notes that 53.9 million people were subscribed to one of the 183 different SVOD platforms operating in Europe in 2017. The local players, however, had a significantly lower share: UK’s Now TV (2.7%), Italy’s TIM Vision (2.5%) and Germany’s Maxdome rounded off the Top 5.

Streaming services are especially popular in the Nordics with Denmark, Norway, Sweden and Finland showing penetration rates between 47% and 73% in 2018, followed by the U.K. with 41%.

The Nordic countries lead the European VOD market partly because of the high percentage of English-speaking population, high speed and reliable broadband, a large selection of services — many of which offer livestreaming TV networks — and a number of partnerships between online and traditional players. Denmark leads the European market in terms of penetration with 53% of the households using such services and 35% subscribed to two different streaming offers.

In the Nordics, however, Netflix and Amazon have a smaller share than in the rest of Europe (39% - according to Mediavision) which is explained with the increased competition from local actors – the biggest one being Viaplay with nearly 1.3 million subs. Both C More and Viaplay generated a 2% share of the total European SVOD revenues (€3.65 billion) in 2017, according to Ampere. In Denmark, Netflix holds 44% share, HBO Nordic - 23%, Viaplay - 22%, TV 2 Play - 21% (reported half a million subs) and C More - 7%.

AVOD in the Nordics is also huge thanks to the Play services of the major commercial nets and in 2018 alone the market grew by 20%, according to IRM. Bonnier Broadcasting’s TV4 Play reported 4.7 million subscribers for 2018 with its share on the Swedish commercial streaming market increasing to 54%. Discovery’s Dplay grew the most in terms of started streams and reached 17% share.

The public broadcasters also manage to remain relevant and in Finland the public streamer Yle Areena is the most popular platform on the market. The services of DR, NRK and SVT are also ranked second in their markets.

In the UK, BBC iPlayer is also a force to be reckoned with. Last year, 3.6 billion programs were requested on the platform, with Bodyguard’s Episode 1 getting the most streams – over 10.8 million.

The latest data from BARB (The Broadcasters’ Audience Research Board) shows that the number of homes now accessing at least one among Netflix, Amazon or Now TV in the UK has grown by 5.7% to reach 12.3 million, with 660.000 additional homes taking at least one SVOD service compared to the previous quarter. Whilst every Q4 has shown growth, Q4 2018 was the lowest since 2014. Quarter-on-quarter growth for Q4 was 7.6% in 2017, 8.7% in 2016, 6.6% in 2015 and 3.7% in 2014. 43% of homes now have access to one of these SVOD services in the UK. In a recent netgem.tv survey, 59% of the respondents said they have pay TV at home and 58% said they have a Netflix or Amazon Prime TV account.

Futuresource Consulting published a report in January about the German video market – it stepped up its dynamic transition in 2018, driven by subscription spending. Consequently, it is the 5th largest in the world with an estimated annual spend of €9 billion in 2018, up 6% on 2017. The annual consumer spend is on course to exceed €10 billion by 2022. There are now over 10 million households subscribing to one or more SVOD service. Here, Netflix increased its subscriptions with 50% in 2018 alone. Last year, data from Ampere and VOD service Cirkus forecasted that Germany may surpass the UK as Europe’s strongest video-on-demand market.

France is the third biggest European SVOD market in terms of revenues but well outside the Top 10 markets in terms of subscribers but catching up fast. In 2018, the French VOD market grew by 82.7% to reach €455 million. Netflix now counts 4 million clients in France, while the local broadcasters are planning to unite their forces with the launch of the rival service Salto.

Spain and Italy are in a similar situation, generating around 200 million per year in 2017 with a penetration of less than 20%. However, a recent study by Ernst & Young showed that in Italy paid video subscriptions increased from 2.3 to 5.2 million in 2018, getting closer to the 6.5 million mark of pay TV subs. The number of SVOD users has nearly doubled to 8.3 million, and with AVOD the reach jumps to 23.8 million.

In the Netherlands, Netflix clearly dominates the SVOD market with close to 3 million households using the service. The closest competitor is RTL’s Videoland which has about six times less subscribers, even though their number increased with 135% in 2018 and the VOD revenues reached €216 million. At the same time, SKO estimated that 59% of the population aged 6+ watched content for the national broadcasters online last year. Shows that also aired on TV reached 3.2 million viewers, while the web-only projects had 2.6 million viewers. Shows that also aired on TV reached 3.2 million viewers, while the web-only projects had 2.6 million viewers. The monthly online reach for the channels was 3.7 million. NPO reached 2.583.000; RTL - 1.199.000 and Talpa TV - 513.000 viewers online.

Russia is the biggest VOD market in Eastern Europe with an estimated value of 23.6 billion rubles (approx. $368 million) growing nearly 50% last year. The biggest platform ivi which combines the SVOD and AVOD model counted 43 million unique users in 2018. The number of paying customers doubled in one year to 1.2 million. The revenue increased by 62% to 3.9 billion rubles. Leading SVOD service Okko increased its revenues by 81% last year, reaching 2.5 billion rubles. Its monthly audience in 2018 was 1.83 million people, up from 1.5 million in 2017.

In Poland SVOD services are also becoming increasingly popular. Data published by Statista shows that revenue in the segment will amount to $145 million in 2019. Revenue is expected to show an annual growth rate (CAGR 2019-2023) of 1.6%, resulting in a market volume of $155 million by 2023. The user penetration is 18.3% in 2019 and is expected to hit 20.2% by 2023. The average revenue per user (ARPU) currently amounts to $20.81.

According to a survey by Projekt Cyfrowizja IV, as many as 24% customers of satellite and cable platforms have been considering discharging paid services last year, most often customers of the most expensive plans (over PLN 100 monthly subscription - 30%).

The rise of the popularity of SVOD services in Europe has also attracted the attention of the European politicians and in October 2018 the EU approved content quotas. The new regulations will take effect on Sept. 19, 2020 and will require video-streaming companies that operate in the EU to ensure that 30% of their catalog is made up of European works. However, what “30%” means isn’t yet clear—it could refer to hours of content, number of videos, or something else altogether. Clarifications will be made by the end of 2019, after which streaming companies will have less than a year to comply with the finalized rules.